Have you heard about Kelan Kline, the co-founder of a personal finance blog, who lost 40 pounds in two seasons? His approach was simple: He opted for exercise, swimming, and walking to stay fit. And he spent $45 for a yearly gym membership at a local college. According to him, “The beauty of working out is you can literally do it anywhere and it doesn’t cost high.”

What is Healthy Lifestyle?

Let’s examine what a health-conscious lifestyle is: Imagine two individuals who prefer different types of foods; one enjoys processed or fast food, while the other likes nature-based edibles, i.e., fruits and vegetables. Understandably, the latter individual will reap the benefits of a healthy lifestyle: Better health, lower medical expenses and higher work efficiency will result thereof.

Video Link: https://www.youtube.com/watch?v=Y8HIFRPU6pM

Is it Cost Effective?

According to a study on healthy food policies’ outcomes in Medicaid by four recognized doctors, it was concluded that a 30% subsidy on nutritious foods would prevent around 3.28 million heart-related disease events and save approx. 100$ billion dollars in health care costs compared to a 30% subsidy for fruits and vegetables that would prevent 1.9 million cardiovascular disease events and conserve 40$ billion dollars in health care costs.

Likewise, on a smaller scale, individuals can combine different activities to enhance their lifestyle: enjoy a mix of natural edibles, do exercise, manage sleep, or drink ample quantity of water. Such actions, if planned perfectly, can promote growth as well as long-term savings.

Most individuals prefer walking for 30 minutes each day to reduce the risk of joint pains, diabetes, and heart disease. It also limits certain types of cancer. Likewise, drinking approx. 11 to 15 cups of water per day can improve digestion, reduce heartburn, and prevent stomach ulcers. All in all, these actions can help conserve your spending over a long period of time.

Lessening bad habits can also have the same effect: According to the ALA (American Lung Association), on an average, an individual smokes 15 cigarettes a day. If the smoker wants to reduce his expenditures, he can curtail smoking to 10 or 5 cigarettes a day. Concurrently, it will improve his health and well-being.

N.B. On a positive note, it’s better to say ‘no to cigarettes’ altogether.

Benefits

To maintain a healthy lifestyle, you need to assess your requirements, such as diet schedules, fitness levels, and monetary spending. Plan your routine for favorable outcomes, such as:

- Lower Insurance Premiums

- Increased Productivity and Income

- Improved Mental Health

- Less Stress

Tips for Maintaining a Healthy Lifestyle

1. Set Realistic Goals

A healthy lifestyle and savings go hand in hand. Prioritize your life by setting health-improvement goals for financial cut-downs. For example, enjoying a plate of salad before every meal, or cycling for 30 minutes every day.

Some of the best strategies to achieve health-oriented objectives are:

- SMART goals

- 80/20 Rule

- Habit Stacking

- 30-Day Challenge

- 2-Minute Rule

2. Create a Budget

Allocate your resources wisely. Keep a register or maintain an online record for disseminating expenses for fitness. More so, use AI to help automate your budget requirements. A proper and comprehensive financial plan helps in achieving short and long term goals effectively.

N.B. Ensure every activity is aligned with cash limits, preferably low and high range.

3. Seek Professional Guidance

Expert trainers and financial advisors are positive influencers who can ensure cost savings and health improvement with a sound strategy. After all, health is wealth!

According to a 36-year-long research on the effect of health practices on life expectancy by NHS and HPFS, it was concluded that individuals who met the criteria for the five chosen fields (diet, body weight, physical activity, smoking, and alcohol consumption) lived longer and healthier lives: 12 years for men and 14 years for women.

4. Plan Meals

A budget meal plan is a good resource to use and benefit from. You can download it from the Internet, consult an expert, or make a customized one. The best option, however, is the last one. Schedule your plan weekly: Which days would you like to eat at home, how to manage leftovers, and when to visit the market for more ingredients. Every action is a means to an end!

N.B. Allocate money according to your meal plan: No under or overestimation.

Video Link: https://www.youtube.com/watch?v=SlZbf7uKtQA

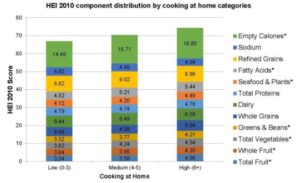

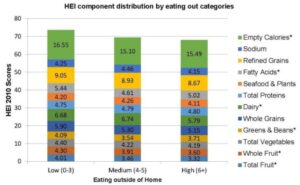

5. Eat at Home

A healthy and hygienic decision for most. Enjoying nutrient-dense food ensures an active lifestyle, with adequate intake of ingredients and no symptoms of depression or stress being the prominent benefits. Cooking meals at home is also a cost-saving option: According to research, dining at home reduces per capita food expenditure (as low as $273/month).

Another report by Thow and Downs relates to cost prices and fresh food intake: People eat more naturally-grown foods (25%) when buying costs are lessened by 50%.

“Keeping your body healthy is an expression of gratitude to the whole cosmos – the trees, the clouds, everything.” as said by Thich Nhat Hanh, the famous Vietnamese peace activist. Curtail your costs by planning ahead of time and maintaining a healthy diet.

Start Now!